Featured

Table of Contents

Consumers who register in the AMP program are not qualified for installation plans. Web Power Metering (NEM), Straight Accessibility (DA), and master metered clients are not presently qualified. For clients planning on moving within the next 60 days, please put on AMP after you've developed solution at your brand-new move-in address.

Governments and organizations use these forgiveness programs to promote professions in fields that supply public service yet might not provide wages. Instances include mentor in poorer locations or exercising medication in inner rural neighborhoods. One crucial element of financial debt mercy associates with tax condition. The basic rule for the internal revenue service is that forgiven debt income is taxed.

The PSLF program is for consumers who are utilized full time in certifying civil service jobs. You would certainly have to be eligible when you have made 120 certifying payments under a certifying settlement strategy while functioning for a qualifying company. As soon as you have actually fulfilled this demand, the balance on your Direct Lendings is forgiven.

The Greatest Guide To Widespread False Beliefs Regarding Debt Forgiveness

This is to motivate educators to offer in areas where they are most needed. IDR plans to change your monthly student loan payment quantity based on income and family dimension. Any kind of superior equilibrium is forgiven after 20 or 25 years of qualified settlements, relying on the specific selected real strategy.

During the COVID-19 pandemic, the united state government executed temporary alleviation measures for its federal pupil financing debtors. The CARES Act put on hold lending settlements and established interest rates at 0% for eligible government pupil financings. It was seen as a short-term relief procedure, it was not finance forgiveness. Personal trainee lendings can not be forgiven under the government funding forgiveness programs because they are released by exclusive lending institutions and do not bring the backing of the federal government.

Refinancing: In some cases, a customer obtains a new loan with better terms to settle existing loans. Settling might involve a reduced rate of interest or even more manageable regular monthly payments. Debt consolidation: combines several financings right into one, making the settlement simpler. Great credit score is needed, so not all consumers might qualify.

The smart Trick of The Benefits and Drawbacks When Considering Debt Forgiveness That Nobody is Discussing

Some personal lenders offer case-by-case hardship programs. These consist of temporarily making interest-only payments, momentarily lowering repayments below the contract price, and even other forms of holiday accommodations.

Some of the debts forgiven, especially obtained from financial debt negotiation, additionally negatively impact debt ratings. Typically, the debate regarding financial debt mercy concentrates on its long-lasting effects.

Forgiveness of huge amounts of financial obligation can have substantial fiscal effects. It can add to the national financial obligation or demand reallocation of funds from various other programs.

Understand that your fundings may be strictly federal, strictly private, or a combination of both, and this will certainly factor right into your options. Mercy or payment programs can conveniently straighten with your long-term financial goals, whether you're acquiring a residence or planning for retirement. Recognize how the various kinds of financial debt relief might affect your credit history and, later on, future borrowing ability.

All About The Future for Debt Forgiveness and Consumer Options

Offered the prospective tax ramifications, getting in touch with a tax expert is suggested. Debt forgiveness programs can be a genuine lifesaver, yet they're not the only method to tackle mounting debt. These strategies change your federal pupil funding payments based on your revenue and household dimension. They can lower your regular monthly payments now and may forgive your continuing to be financial debt later on.

You can utilize monetary apps to watch your spending and established money objectives. Two ways to pay off debt are the Snowball and Avalanche methods. Both assist you concentrate on one financial debt at a time: Pay off your tiniest financial debts. Settle debts with the highest rates of interest first.

Before choosing, assume concerning your own cash situation and future plans. This means, you can make choices that will certainly help your finances in the long run. Canceled Financial Obligations, Repossessions, Foreclosures, and Desertions (for People).

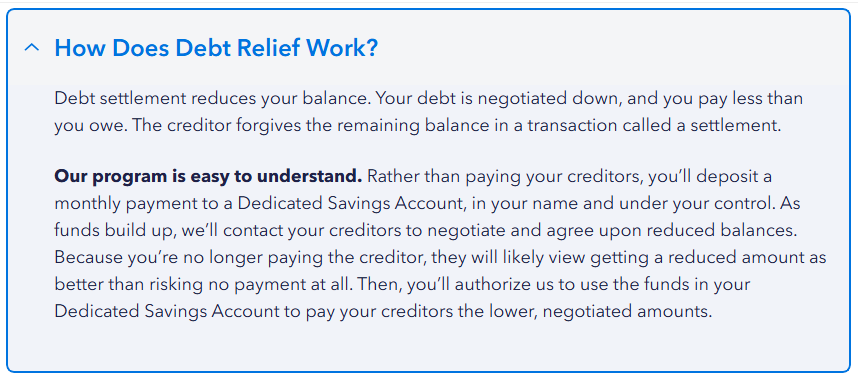

Unlike financial debt combination, which integrates multiple financial debts into a single financing, or a debt administration plan, which reorganizes your settlement terms, financial debt forgiveness straight decreases the primary equilibrium owed. This approach can give prompt alleviation. However, there are some ramifications and potential threats to maintain in mind prior to you choose to relocate forward.

State Resources That Offer Debt Relief Things To Know Before You Get This

Financial debt settlement entails working out with lenders to accept a lump-sum settlement or layaway plan that amounts to much less than the complete debt owed. The staying equilibrium is then forgiven. You may pick to bargain a negotiation by yourself or get the aid of a financial obligation settlement company or a skilled debt assistance lawyer.

Not just anybody can get charge card debt forgiveness. As a matter of fact, you usually require to be in alarming financial straits for lenders to also consider it. Particularly, creditors consider different variables when thinking about debt forgiveness, including your revenue, assets, various other financial debts, capacity to pay, and willingness to work together.

The Ultimate Guide To Your First Step to Debt Counseling and What to Bring

In some instances, you may be able to settle your debt circumstance without resorting to insolvency. Prioritize crucial expenses to improve your financial scenario and make room for financial obligation payments.

Table of Contents

Latest Posts

Rumored Buzz on No-Cost Accessible Financial Literacy Workshops That Help Consumers

Some Ideas on Preventing New Debt Cycles After Mortgage Help for Low-Income Families: What Options Do You Really Have? : APFSC You Need To Know

The smart Trick of How APFSC Help Clients with Families That Nobody is Talking About

More

Latest Posts

Rumored Buzz on No-Cost Accessible Financial Literacy Workshops That Help Consumers

The smart Trick of How APFSC Help Clients with Families That Nobody is Talking About